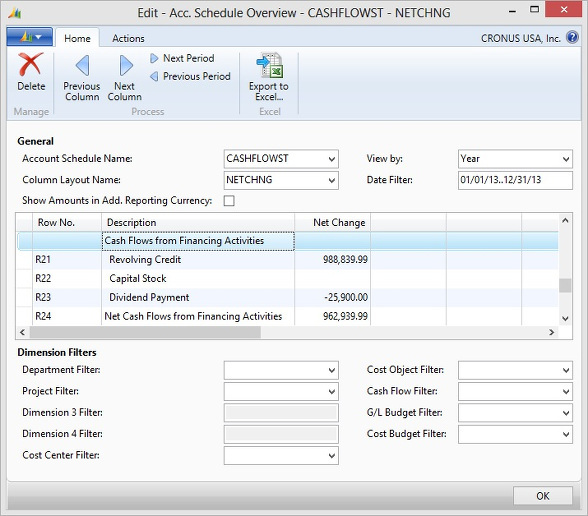

The next section of our Cash Flow Statement covers Cash Flows from Financing Activities.

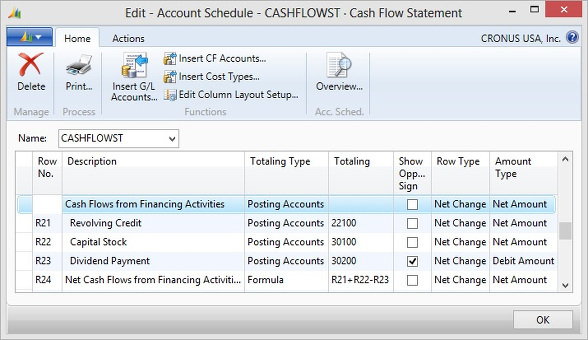

In 2013 CRONUS USA Inc. borrowed on the Revolving Credit Account, resulting in a debit balance on G/L Account 22100. This debit balance represents a cash inflow and Row R21 adds the balance to the Cash Flows from Financing Activities.

Row R22 stays blank because there was no stock issuance or stock retirement.

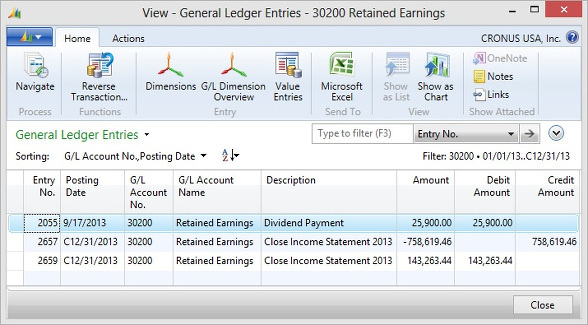

Row R23 reports a dividend payment. The dividend payment debited G/L Account 30200 Retained Earnings. You can see in the design above the Amount Type in Row R23 is set to Debit Amount, reporting only debits posted to Retained Earnings. This set up will work for our test data, but it will fail as soon as someone posts any corrections to Retained Earnings.

You can change the Amount Type back to Net Amount in Row R23, reporting all entries posted to Retained Earnings throughout the year as dividend paid. If all you ever posted to Retained Earnings are dividends paid, our Cash Flow Statement is still correct. But if there are any postings to Retained Earnings that did not result in a cash outflow, our Row R23 does not report the correct amount.

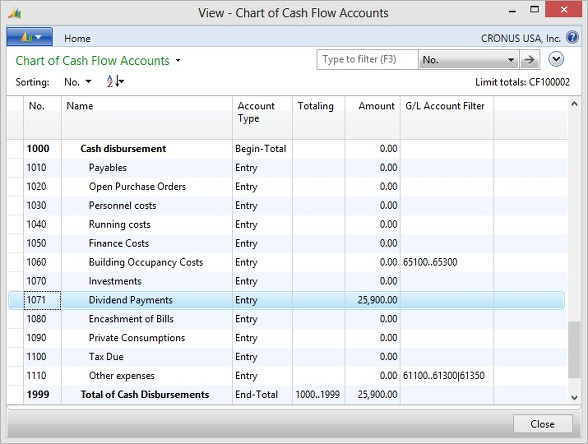

To report dividend payments correctly, I added another Account 1071 Dividend Payments to the Chart of Cash Flow Accounts:

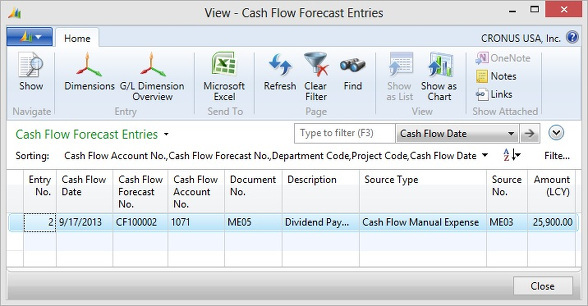

I again registered a single Cash Flow Manual Expense Entry to the same Cash Flow Forecast CF100002 I already used for the Fixed Asset disposal correction:

Final Report: Net Cash Flow from Financing Activities